How Salaried Expats in UAE can apply for Mortgage / Home Loan

Are you looking forward to buying your dream home in the UAE but not sure how to complete the property purchase with a Mortgage as a salaried person? You are not alone, and you are in the right place.

Let’s understand the process step by step as per UAE Banks standard.

📘 Let’s Understand Mortgages for Salaried individuals

What is a Mortgage?

A mortgage or a home loan is a borrowing you take from the bank to buy a property, whether for your own usage or for an investment. In return, you pay the bank monthly installments (EMI’s) which is a combination of principal and interest.

It’s like a long-term property rental agreement, where you pay rent for the agreement period and the only difference is that you will become the full owner of the property at the end of the agreement period.

How Mortgage Works in the UAE

In the UAE, banks offer mortgages to salaried people based on their monthly income, job stability, credit profile, and nationality. The bank pays the property seller, and you pay the bank in EMIs (monthly installments) over 15 to 25 years.

Benefits of Taking a Mortgage as a Salaried Client

-

You don’t need to pay 100% of the property value

-

Interest rates are relatively low

-

You build equity over time

-

Many banks offer special perks for salaried professionals

📝 Who Can Apply? Eligibility Criteria in UAE

Minimum Salary Requirements

Most UAE banks require a monthly salary of AED 8,000 to AED 15,000. The higher your income, the better the mortgage deal.

Employment Duration & Employer Type

You should be employed for at least 6 months to 1 year. Some banks may also require your company to be listed with them, but at Compare4Benefit, we help even if your company is not listed.

Visa and Residency Conditions

You need to hold a valid UAE residence visa. If you’re on probation or just moved jobs, you might need to wait until your probation is over.

Age & Credit Score Requirements

You must be 21 years or older, and typically not older than 65 at the end of the loan. A credit score above 650 is preferred, though some banks accept lower with conditions.

📂 Required Documents Checklist

Don’t worry—we’ll help you organize all these:

-

Passport & visa copy

-

Emirates ID

-

Salary certificate

-

Bank statements (6 months)

-

Latest payslips (If variance in salary)

-

Property documents (MOU, Title Deed) – If Selected

-

Existing loan/card liabilities

💸 Down Payment and Loan-to-Value (LTV) Rules

Down Payment for Expats vs UAE Nationals

-

Expats: Must pay 20% down payment for properties under AED 5M, and 30% if it’s above.

-

UAE Nationals: Just 15% down payment for properties under AED 5M.

Maximum Loan Eligibility

Based on your salary and DBR, you can get a loan for up to 80% of the property value.

📉 The Role of DBR (Debt Burden Ratio)

What is DBR?

DBR = Your monthly loan/credit payments ÷ your income. If it’s more than 50%, your mortgage may be declined.

How to Calculate It

Add up your credit card dues, car loan EMI, personal loan EMI, and the expected mortgage EMI—then divide by your salary. You can calculate your DBR now on DBR Calculator UAE

Why DBR Matters for Approval

Banks are strict about DBR. Keeping it below 50% boosts your approval chances and allows higher loan eligibility.

🏦 Compare Mortgage Offers in the UAE

Here’s a quick comparison:

| BANK | RATE OF INTEREST (Starting from) | MINIMUM SALARY | LOAN AMOUNT (MAX) |

|---|---|---|---|

| Standard Chartered Mortgage One | 4.39% (reducing) | 15000 AED | 18 Million AED |

| RAKBANK Home in One | 4.39% (reducing) | 15000 AED | 20 Million AED |

| CBD Mortgage Loan for Expats | 3.99% (reducing) | 15000 AED (Salaried people); 20000 AED (Self-employed) | 10 Million AED |

| Emirates NBD Home Loan for Expats | 3.99% (reducing) | 15000 AED | 15 Million AED |

| Standard Chartered Home Suite | 4.29% (reducing) | 15000 AED | 18 Million AED |

| ADIB Home Finance for Expats | 3.99% | 15000 AED | 15 Million AED |

Compare4Benefit shows rates from 25+ banks—you pick the best!

📊 Flat Interest Rate vs Reducing Interest Rate

Banks in UAE charges interest based on reducing interest rate only, reducing rate is charges on the outstanding amount.

Flat Interest rate is only the average rate of interest charged on the actual loan amount.

For example: Reducing interest rate of 3.49% annually is equivalent to 2% Flat rate if tenure is 25 years.

You can refer Flat rate Vs Reducing rate calculator for better understanding

🔁 Switching to a Better Mortgage (Buyout Option)

Already have a mortgage? You might be overpaying.

What is a Mortgage Buyout?

It’s switching your mortgage to another bank for better terms.

Benefits of Transferring

-

Lower interest rate

-

Cashback deals

-

Flexible tenure

-

In many cases, zero early settlement fee

We handle the full switch for you—zero paperwork stress.

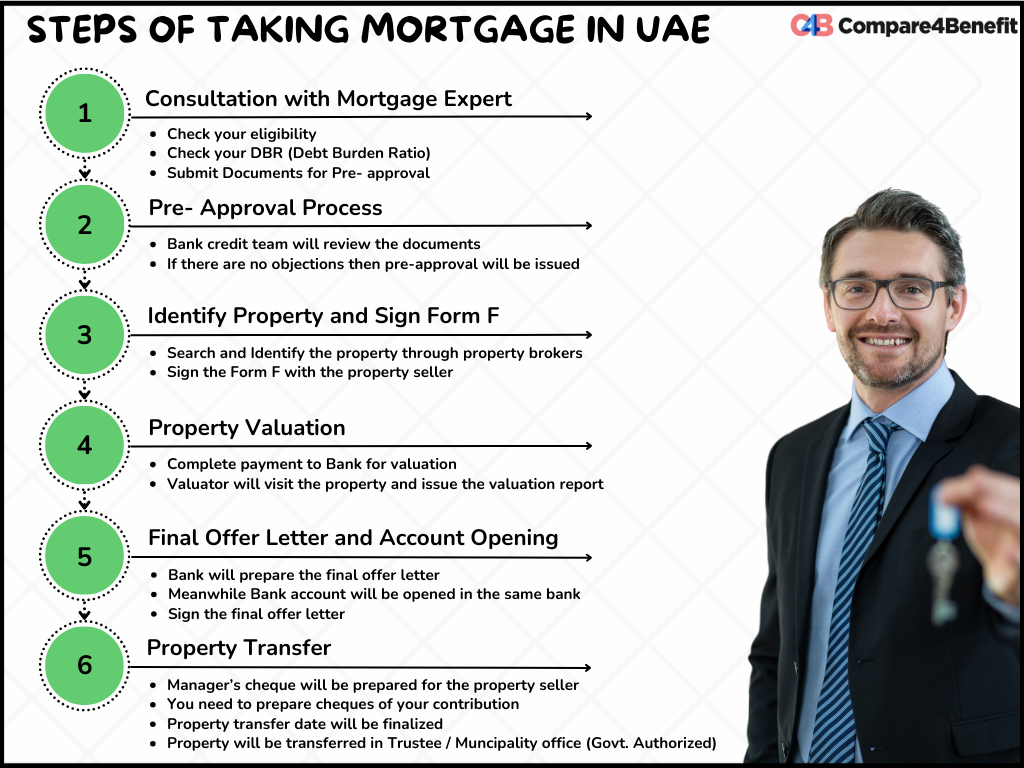

📋 Step-by-Step Mortgage Process for Salaried Clients (Updated)

-

Talk to a Mortgage Expert

Start by speaking with a professional mortgage advisor (like us at Compare4Benefit) to understand the process, your options, and get clarity on the next steps. -

Check Your Eligibility & DBR with the Advisor

Your advisor will check your Debt Burden Ratio (DBR) and salary eligibility with different banks to find the most suitable lender for your profile. -

Submit Documents for Pre-Approval

Once the right bank is identified, submit your documents to apply for a pre-approval. This gives you a conditional approval and confirms your borrowing capacity. -

Finalize the Property

With pre-approval in hand, you can now confidently start your property search and select the right home or investment. -

Sign the MOU with the Seller

Once you’ve selected the property, both you and the seller sign the Memorandum of Understanding (MOU). This outlines the purchase terms and blocks the property for you. -

Bank Conducts Property Valuation

The bank will send an approved valuation company to assess the property’s market value, ensuring it aligns with your purchase price. -

Final Offer Letter (FOL) is Issued by the Bank

After the valuation is complete and accepted, the bank issues the Final Offer Letter (FOL) for your mortgage. -

Client Opens Bank Account & Signs FOL

You will now open a bank account (if not already existing) in the lending bank and sign the Final Offer Letter to proceed. -

Bank Prepares Manager’s Cheques for Seller

Once the FOL is signed, the bank processes and prepares the Manager’s Cheques to pay the seller and cover other charges like DLD fees. -

Transfer the Property at DLD Trustee Office

On the scheduled date, both parties meet at the Dubai Land Department Trustee Office to complete the ownership transfer. The property is now officially in your name. -

Mortgage Loan is Disbursed

After successful transfer, the bank disburses the mortgage loan directly to the seller and your repayment tenure begins.

💼 Fees and Hidden Charges Explained

Bank Charges

-

Processing fee: ~1%

-

Valuation fee: AED 2,500–3,500

Government Charges

-

DLD fee: 4% of property price

-

Trustee fee: AED 4,000–6,000

-

Mortgage registration: 0.25% of loan

We give you a complete cost sheet upfront—no surprises.

🧰 Tools That Make It Easy

-

Free WhatsApp support, calls & emails

💡 Why Choose Compare4Benefit.com

-

Compare from 25+ UAE banks

-

Get exclusive deals with non-listed companies

-

Pre-approvals within 48 hours

-

100% free service for salaried clients

We guide you from start to finish.

🚀 Your Next Step

Ready to take the leap?

👉 Check eligibility

👉 Compare best deals

👉 Book a free consultation at Compare4Benefit.com

✅ Conclusion

Getting a mortgage in the UAE as a salaried client isn’t rocket science—it just needs the right guidance. From understanding DBR to choosing fixed vs reducing rates, we’ve got you covered. With Compare4Benefit by your side, you’ll have your dream home financed in no time—without the headaches.

❓ FAQs

1. What is the minimum salary for a mortgage in UAE?

Most banks require AED 8,000 to AED 15,000 per month.

2. Can I get a mortgage if my company is not listed with the bank?

Yes! We offer non-listed company mortgage options through specific banks.

3. How long does mortgage approval take in UAE?

Initial pre-approval takes 24 to 48 hours. Full approval may take 5–10 working days.

4. Can I get a mortgage as a freelancer or self-employed?

Yes, but it’s trickier than for salaried clients. You’ll need audited financials and tax returns.

5. What happens if I miss an EMI payment?

You may face late fees and credit score impact. It’s best to inform your bank in advance if there are any issues.

Inbound Link Suggestions:

Outbound Link Suggestions: